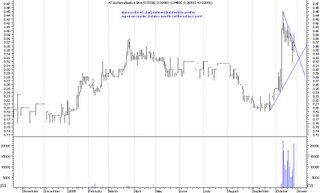

Today IFCA has shown the signal to enter , this afternoon (20/4/06)close at 0.485 , the strong support at 0.40 , pls put on your safety belt if you want to enter the market.

This stock is buy high sell higher method, of course the risk and the gain is propotional to each other.

Prepare you cut loss point & if the stock goes up, pls set your profit taking point.

but bear in mind , if the stock drop below 0.4 , you have to exit this stock.

To those who interested in IFCA on 21/4/06:

-If the price at 9am to 10am is at negative , pls dont buy in.

-If the price of IFCA at 11am is higher than 9am, you can consider to buy in a. If lower than 9am, pls dont buy in.

-If you had bought during 9 am to 10am, you need to monitor 11am, if 11am is lower than 9 am, you need to be careful. if higher than 9 am, you can let the profit run & monitor again on 3.30pm

-If you bought in on 11am, you need to watch out on 3.30pm , if the price is below 11am, you need to be careful, if the price more than 11am, you can let the profit run.

-Pls refer to the time pattern to execute the action.The above time pattern only applicable on IFCA tomorrow only.

The time pattern will vary from time to time and counter to counter, pls do not use the above mentioned time pattern to execute for other counter, it may give you some fault signal.

To anybody who like to learn the TPS(trigger point system), can you send your name and contact number to teybl05@yahoo.com.sg , i will arrange some preview session of TPS to you.

TPS (Trigger point system ) is consists of chart pattern, volume pattern, price pattern and time pattern.The course also included of how to handle a case after you buying, what are thing you need to look after, you will definately know what to do and to make decision before/after you enter the market.The course will be conducted in Chinese language.

Disclaimer: This blog is not to be construed as a recommendation to buy or sell any securities. All information and comments are provided for educational purposes only. I however do not hold myself responsible for its accuracy as well as your stock trading or investing decision.